How to use The Forecaster Interactive

Discover the Truth

about The Forecaster

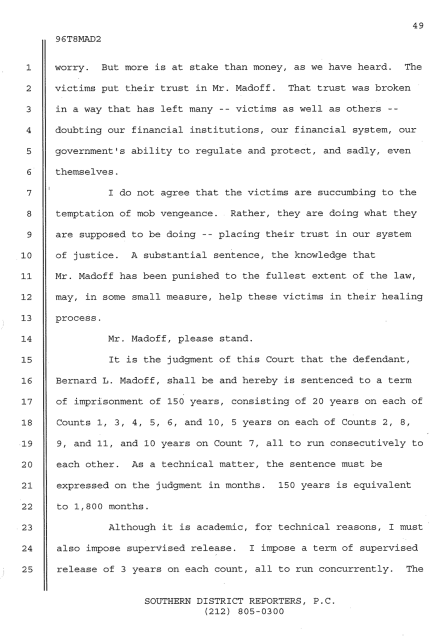

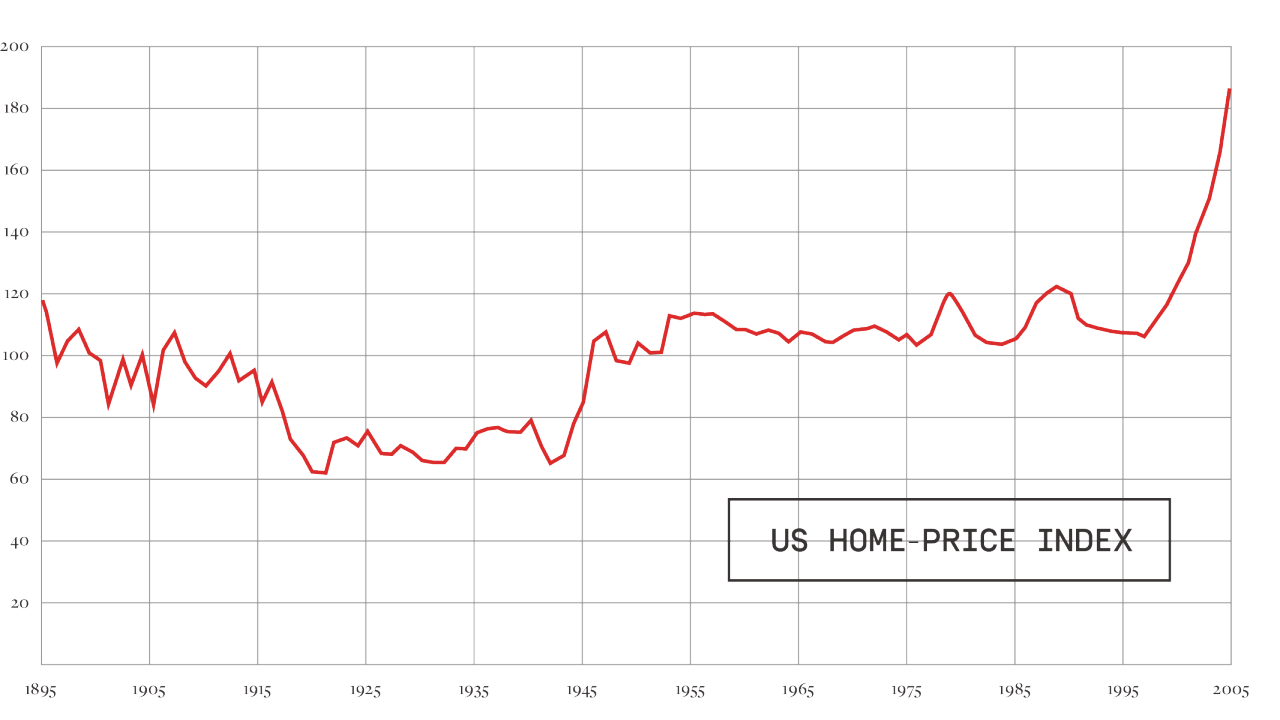

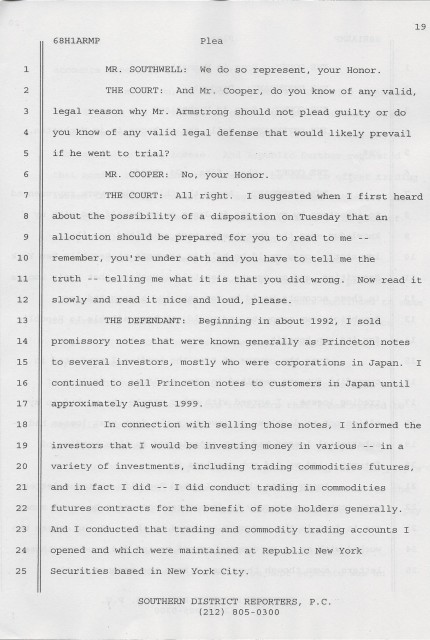

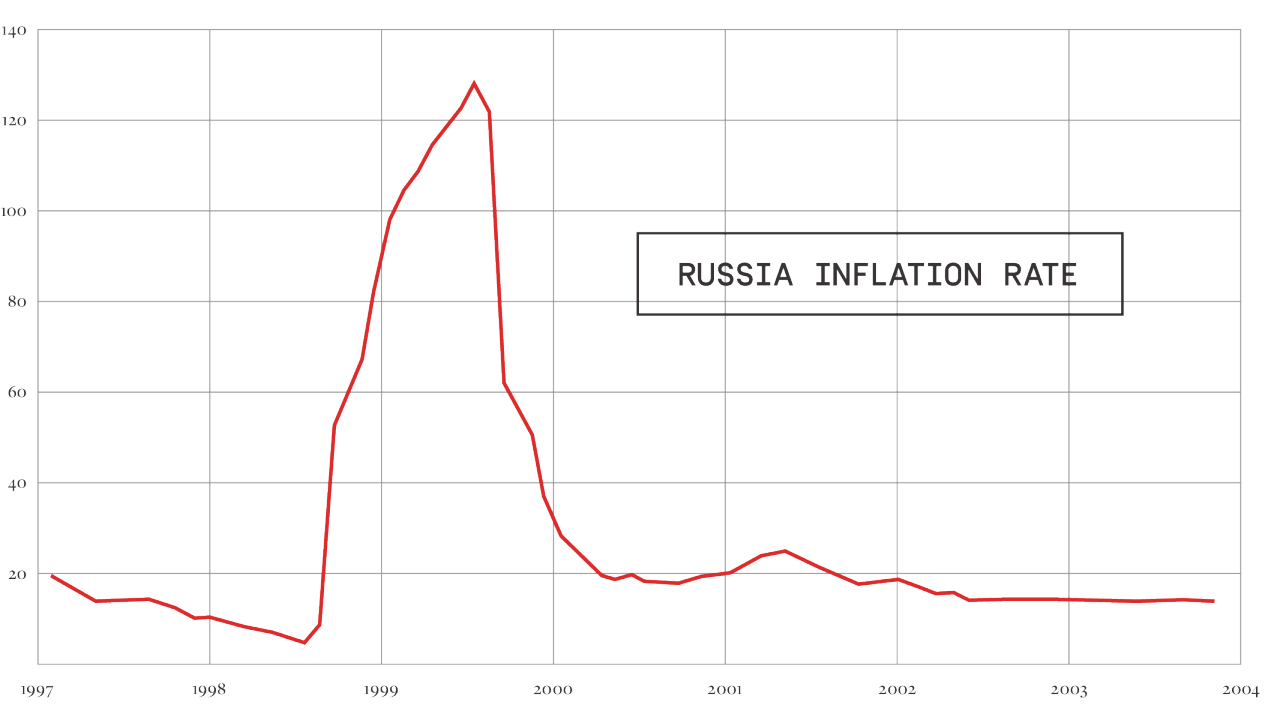

The Euro crisis, out of control government debt, popping real estate bubble, military conflicts – and one man who predicted it all. The documentary The Forecaster tells the story of Martin Armstrong, whose predictions in the 1980s shook entire economies. When he refused to manipulate the markets, Armstrong became the subject of an unprecedented miscarriage of justice.

The Forecaster Interactive is the online companion to the movie. With exclusive videos, interviews, original documents, and curated news articles, you can dive into the world of Martin Armstrong. Is he a con man or a genius? Using the evidence and source materials in the timeline, you can check Armstrong’s statements and decide for yourself. Are his forecasts right? Use the menu to jump to key moments in the film and the filters to search for specific information and explanations.

Click here to view the introductory video.